It introduces over 20 trend, momentum, volatility and volume indicators. This course is, in our opinion, the very best technical analysis course and study guide you can find. It is important to mention the fact that a new brick is only placed under certain volatility criteria, either resulting in a major advantage or disadvantage for traders. It can be placed in a matter of minutes or take more than a day depending on market conditions.

Create bigger, better, more advanced charts and save them to your account. Run custom scans to find new trades or investments, and set automatic alerts for your unique technical criteria. Plus, with daily market commentary from industry-leading technicians, you can follow the experts and see the latest charts they’re watching.

Technical Analysis Using Multiple Timeframes

The best place to start is by studying long-term charts, such as monthly and weekly charts spanning several years, as these give a good overview. Once a trader has gained this perspective, daily and intraday charts can be consulted. This approach helps, because a short term view in isolation can be deceptive.

Motivewave Review 2023 – Modest Money

Motivewave Review 2023.

Posted: Thu, 05 Jan 2023 08:00:00 GMT [source]

If a stock you thought was great for the last 2 years has traded flat for those two years, it would appear that Wall Street has a different opinion. If a stock has already advanced significantly, it may be prudent to wait for a pullback. Or, if the stock is trending lower, it might pay to wait for buying interest and a trend reversal.

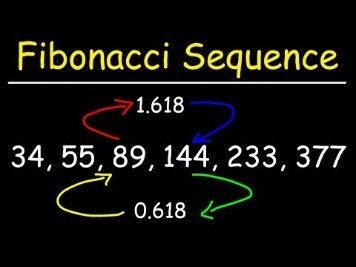

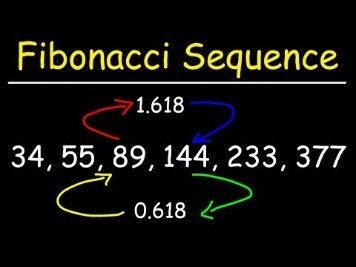

Therefore, past trends can be used to help interpret future price movements. With this technical analysis book buying guide, you can learn the ins and outs of technical analysis to help you make the wisest investment decisions possible. In this buying guide, you are sure to find a book that best suits your goals and needs in the world of trading. A simple moving average is calculated taking all the closing prices for a given period and then summing them up and dividing by the number of stock prices used.

Overall, Getting Started in Technical Analysis by Jack D. Schwager offers a lot for both, beginners and experienced traders. That is the reason that it easily gets its spot in the list of best technical analysis books of all time. The book helps beginners to get started by explaining important chart patterns and technical indicators. It also explains how to interpret chart patterns and predict prices of different assets. The book gets itself in the list of the best technical analysis books.

The chart of IBM illustrates Schwager’s view on the nature of the trend. The broad trend is up, but it’s also interspersed with trading ranges. In between the trading ranges are smaller uptrends within the larger uptrend. The uptrend is renewed when the stock breaks above the trading range.

Ques – What is the purpose of Technical Analysis in stock market?

So, the volume is one of the crucial factors in this type of analysis. Volume is the number of shares that are traded for a particular security in one single day . The main difference between the two is that HA charts represent the average price of the security and not the exact opening and closing prices.

The impressive number of analytical tools available in the MetaTrader 5 terminal cover most of the needs of the modern trader. The MQL5 development environment and all the additional services for technical analysis offered on MetaTrader 5 have raised the level of analytical options through the roof. Japanese candle charts are older than bar charts but were completely unknown in the West until Steve Nison introduced them through his articles, seminars, and his books. This book provides an in-depth explanation of candlestick plotting and analysis through hundreds of examples. Understand how candlestick techniques can provide early reversal signals, and improve your timing entering and exiting markets. The Dow theory on stock price movement is a form of technical analysis that includes some aspects of sector rotation.

Robinhood vs. Webull 2023 – Investopedia

Robinhood vs. Webull 2023.

Posted: Tue, 25 Oct 2022 19:47:15 GMT [source]

In addition to covering chart patterns and technical indicators, the book takes a look at how to choose entry and exit points, developing trading systems, and developing a plan for successful trading. These are all key elements to becoming a successful trader and there aren’t many books that combine all of this advice into a single book. With Yahoo Finance Plus Essential, you can add technical analysis and event indicators to our interactive stock charts to help you identify trading opportunities. Our partner Trading Central’s patented pattern recognition technology is paired with a broad range of technical indicators to apply technical analysis to virtually every financial instrument. We have automated the detection and analysis of events to help investors find, validate and time trades.

What does “This symbol is only available on TradingView” message mean?

Resistance is formed when a rising market hits a high and then falls. The more times a market hits these points of support or resistance and reverses, the more reliable that projected line will be for future levels. They can be used to help make trading decisions and can indicate when a trend is about to reverse.

JEPI and SCHD – What Does TipRanks’ Technical Analysis Signal? – TipRanks

JEPI and SCHD – What Does TipRanks’ Technical Analysis Signal?.

Posted: Tue, 14 Mar 2023 07:00:00 GMT [source]

In the book, topics presented include the different formations, trends, patterns, resistance areas, support areas and other technical details that are needed when it comes to engaging in technical analysis. Also presented are various reliable factors that a person can always look to predict the trends in the market as well as the flawed factors that need to be looked out for when reading various charts. This is a book that should be on any technical analyst’s personal bookshelf.

ADVANCED DRAINAGE SYSTEMS, INC.

Watching a graph and analyzing from the same can be easy in contrast to an endless list of numbers, isn’t it? Since technical analysis represents everything on graphs, it becomes easier for the trader to look for the specific price and volume points and analyst them without getting confused among all the noise. Finally, Bollinger bands are sometimes used as a “breakout” trading strategy. When price trades virtually “flat” for several periods, the bands will narrow considerably. Then, when the price inevitably breaks through either the upper band or lower band, the trader buys or sells accordingly, taking this as an indication of the start of a new trend.

- The book highlights the value of applying technical analysis across multiple timeframes to identify trades with the highest probability of success.

- You don’t need an economics degree to analyze a market index chart.

- Given the volatility of price movements, chart patterns can be difficult to read.

- The time frame a trader selects to study is typically determined by that individual trader’s personal trading style.

Click Here to learn more about our official real-time data plans. With affordable, transparent pricing, flexible renewal options and multiple service levels to choose from, it’s easy to find the account that’s just right for you. Plus, our hassle-free account management makes it simple to cancel at any time – no games, no tricks, no runaround. You deserve to stay focused on the charts without worrying about your bill.

The main differences between fundamental and technical analysis

Moreover, the details and lucidity of the text are also commendable. The book also narrates several anecdotes that are really encouraging. Today, the second edition of the classic bestseller Encyclopedia of Chart Patterns is available. In this new edition, Bulkowski has revised, expanded, and updated the information regarding the technical analysis. Many refer to this book as the bible of technical analysis because of the huge range of information it goes through an extensive content on technical analysis.

For https://trading-market.org/ analysis, stocks which are heavily traded are preferable. It is because the price charts are affected by the dramatic price change. They adjust these price changes by adjusting the historical data which was there before the price change. Multiple indicators help in understanding the overbought and oversold condition of the market.

Intraday trading Best Automatic buy sell signal software technical chart Analysis for Stock Market, Nifty, Option, MCX, Commodity, Currency by Easy live trade. Many technicians use the open, high, low and close when analyzing the price action of a security. There is information to be gleaned from each bit of information. However, taken together, the open, high, low and close reflect forces of supply and demand.

This means that they are looking at and evaluating the overall value of a advance technical analysis, Forex pair, or other markets. These investors are taking into account everything from potential upcoming announcements, balance sheets, and what the potential future value could be. CandleScanner is a technical analysis software which is designed for investors interested in Japanese candle patterns. What makes this application exceptional is that, from the outset, it has been specifically designed for the detection Japanese candle patterns. It is not just yet another add-on to some existing platform, but a full-blown application written by people having extensive knowledge of the topic of Japanese candlestick patterns. Splits, dividends, and distributions are the most common “culprits” for artificial price changes.

This can show you the overall direction price has been moving in on that time frame. Updata Analytics is the best technical analysis software you will find with over 1,000 technical indicators. Our point and figure charts are second to none along with other techniques such as ichimoku charts and market breadth indicators.

Nevertheless, let us familiarize ourselves with the basics of technical analysis. Below are some of the most significant technical analysis patterns to spot when trading. Answer – The entry and exit points are those where you’re entering the market and exiting the market, with entering means buying and exiting means selling. Whenever you are trying to trade directions from the weekly chart, make sure to synchronise it with the daily chart to time entry. The reason behind is price derived not only by demand and supply but many fundamental forces and thus it is important to incorporate the same.

If prices move above the upper band of the trading range, then demand is winning. Because momentum indicators measure trend strength, they can serve as early warning signals that a trend is coming to an end. Moving averages are probably the single most widely-used technical indicator. A simple moving average trading strategy might be something like, “Buy as long as price remains above the 50-period exponential moving average ; Sell as long as price remains below the 50 EMA”.

- Technical analysis traders have a core assumption that the price is always correct.

- Ideally, the high should extend above the previous candle’s high and a new low should be created – signifying renewed downward selling pressure.

- Price then forms a bearish engulfing bar that is a bearish price action signal and is a signal to make short trades with the trend lower.

- However, some veteran users of the Ichimoku choose to filter the signal by only taking a buy signal when both the tenkan and kijun lines are above the cloud.

- If you like using charts and data to uncover trends in stocks and other investments, learn more here about technical analysis.

When a solid downtrend is in place, prices tend to range between the midline and the lower band, often hugging right along the lower band line. The kijun line is interpreted as showing nearby support or resistance and, for that reason, is often used to identify where to place an initial stop-loss order when entering a trade. It may also be used to adjust a trailing-stop order as the market moves. As with the tenkan sen, the slope of the kijun sen is an indicator of price momentum. The book is the best bet to be a top technical analyst and investor.

As a result, market fundamentals for safety, the sector to which the security belongs, and the market as a whole should support the pattern. The Kijun sen indicates the average of the highest high and lowest low. The Kijun line is commonly used to determine where to put an initial stop-loss order when initiating a trade because it is perceived as signaling close support or resistance.

As per their requirements we are only allowed to stream delayed data. If you just want to have a basic financial chart for the general user, it makes sense not to overload the widget with extra options. You may also want to make it an Area chart, which is the most basic charting type – and looks great without taking up too much space!. If it’s still too much, take a look at our Market Overview and Symbol Overview widgets. During a sustained trend, candlesticks typically assume longer bodies and shorter wicks or shadows on either end.