Contents:

Alternatively, the customer may cancel the service before you have a chance to complete it. Regardless, there are instances in which your business may not generate revenue from a purchased product or service. If you recognize revenue as earned prematurely, it will throw off your business’s financial records.

This follows legal principles relating to the transfer of property. Similarly, an expense should be recognized when goods are bought or services are received, whether cash is paid or not. An accounting period is an established range of time during which accounting functions are performed and analyzed. Explain the purpose of the revenue realization principle. This principle is an effective tool when expenses and revenues are clear.

Explain how to remember accounting normal balances for each account. Explain how might accounting representations have enabled an overstatement incident to take place, taking into account the claim that accounting mirrors, can objectively represent economic reality. Determine at least two ways that accounting or accountants can have a direct impact on society. Explain and show an example of how the FASB’s conceptual framework is needed in formulating standards on controversial topics. Explain the concept of responsibility accounting and its relation with budgeting. Discuss the importance of conceptual framework and why it is important when establishing new accounting rules.

How Does GAAP Mandate the Accounting of Revenue?

For example, in a SaaS company, revenue would be from the sale of monthly or annual subscriptions. It offers a clearer and more accurate representation of your business’s finances. For understanding purposes, the revenue recognition principle is applied in three broad scenarios below. Define the concept of materiality and explain its implication in the preparation of financial statements. Define and discuss how to compute equivalent units and explain their use in process cost accounting. With reference to normative accounting theories, explain whether you agree that there should be a separate accounting standard for intangible assets.

For instance, the business has delivered goods to the customers on March 20th. So, the revenue needs to be recorded on 20th March because risk and rewards have been transferred on this date. Out of all these approaches, the last one i.e. recording revenue when the goods have been delivered is the right approach for recording the revenue. It’s the point when related risks and rewards of the deal have been transferred to the customers. Explain how accounting principles affect financial statement analysis.

Answers

Write a short paragraph to explain the concept of depreciation as used in accounting. Explain the conventional accounting concept of depreciation accounting. Describe the concept of responsibility accounting and explain how this might be implemented in an organization. The Realization Concept states that revenue should only be recognized when the legal obligations are complete for revenue generation.

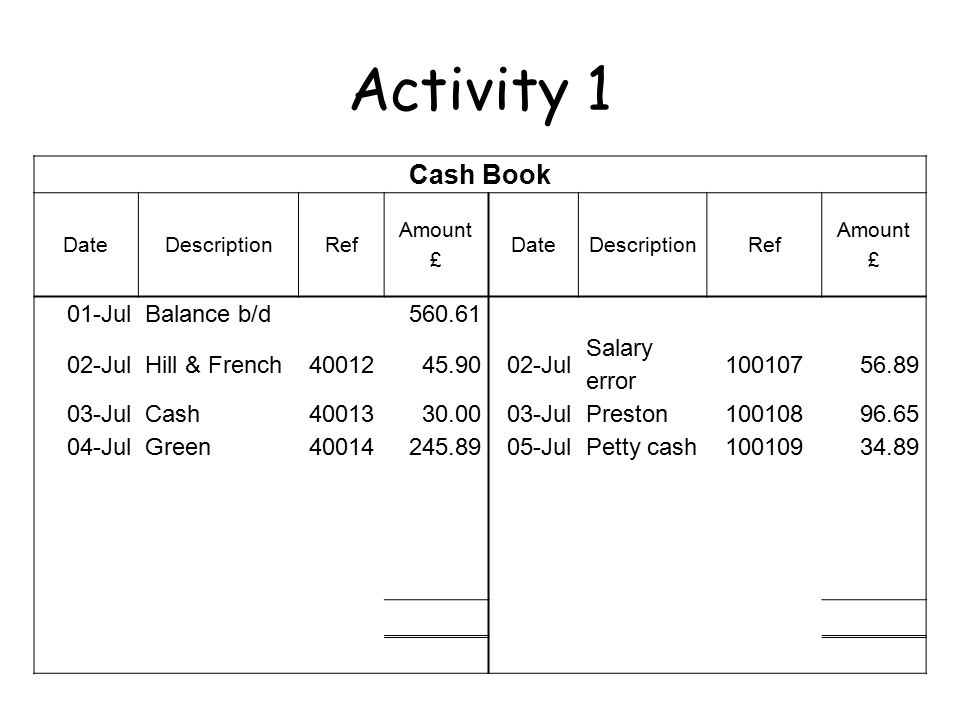

These items are necessary, but may not correlate to revenue. The expense must relate to the period in which the expense occurs rather than on the period of actually paying invoices. For example, if a business pays a 10% commission to sales representatives at the end of each month. If the company has $50,000 in sales in the month of December, the company will pay the commission of $5,000 next January.

Increasing an expense is always shown by means of a debit; decreasing an asset is reflected through a credit. Notice that the word “inventory” is physically on the left of the journal entry and the words “accounts payable” are indented to the right. This positioning clearly shows which account is debited and which is credited. In the same way, the $2,000 numerical amount added to the inventory total appears on the left side whereas the $2,000 change in accounts payable is clearly on the right side. A journal entry is no more than an indication of the accounts and balances that were changed by a transaction. A marketing team crafts messages to entice potential customers to visit a business website.

What are the Challenges of Matching Principle?

If the https://1investing.in/ involves income, the revenue should be recognized at the time the income is due. There must also be a reasonable expectation that the revenue will be realized either presently or in the future. The thing to note is that revenue is not earned merely when an order is received, nor does the recognition of the revenue have to wait until cash is paid.

Teva Reports Second Quarter 2022 Financial Results – Yahoo Finance

Teva Reports Second Quarter 2022 Financial Results.

Posted: Tue, 26 Jul 2022 07:00:00 GMT [source]

Imagine yourself as an online clothing brand that has received an order of two dresses. The buyer is given the option of paying through a credit card or cash on delivery. One way or the other, the order will be delivered and the payment will be received.

Accounting Standards:

It helps allow a business to control the inflation of profits and revenue. This means that Plants and More would recognize the percentage of total income that would match the percentage of the total job that has been completed. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Determine the amount of consideration/price for the transaction.

double entry accounting is different from income, which is a concept on its own but often gets used interchangeably. Before we go any further, let us look at the concept of revenue. Free access to premium services like Tuneln, Mubi and more. This concept of ”transferring risk and reward and recording revenue” is known as the REALIZATION concept. Explain how depreciation may be justified from an ‘Income and Expense’ view of conceptual primacy. Explain the understating and overstating in accounting in the simplest way.

For the services, revenue is recognized when these services are rendered. If service is rendered in more than one accounting period, the percentage of completion is used in revenue recognition. The realization concept or the revenue recognition principle in accounting is a method used by accountants for recording revenue earned by the business. Analysts, therefore, prefer that the revenue recognition policies for one company are also standard for the entire industry. Having a standard revenue recognition guideline helps to ensure that an apples-to-apples comparison can be made between companies when reviewing line items on the income statement.

- The goods have been delivered in 2005 but the payment was received in March 2006.

- On a larger scale, you may consider purchasing a new building for your business.

- This principle recognizes that businesses must incur expenses to earn revenues.

- However, if customers have the right to a refund, a business could recognize that revenue, but the business needs to include an allowance for the refund.

- Typically, revenue is recognized when a critical event has occurred, when a product or service has been delivered to a customer, and the dollar amount is easily measurable to the company.

- The former is precise and accurate, while the latter is an estimate.

Explain in detail the various accounting concepts and discuss the application of these concepts in the preparation of financial statements. Discuss the realization concept, giving examples of how it has influenced the accounting standards. The realization principle gives an accurate view of a business’s profits by ensuring that income is not recognized until the risk and rewards have been transferred.

Likewise, inhire-purchasetransactions, revenue is recognized in proportion to installments as part of the contractual price. Discuss the implications of accounting concepts and conventions on financial statements. Contractors PLC must recognize revenue based on the percentage of completion of the contract. Cost incurred to date in proportion to the estimated total contract costs provides a reasonable basis to determine the stage of completion.

The matching principle also requires that estimates be made, based on experience and economic conditions, for the purpose of providing for doubtful accounts. This provision leads to a reduction of gross revenue to net realizable revenue to prevent the overstatement of revenues. The realization principle is an accounting concept that involves the recognition — or the realization — of revenue when purchased products are delivered or when purchased services are completed. In other words, businesses don’t consider revenue to be earned until one of these actions has occurred. The creation of goods and services then is completed in the sense that the necessary costs have been incurred or may be estimated objectively.

Typically, revenue is recognized when a critical event has occurred, when a product or service has been delivered to a customer, and the dollar amount is easily measurable to the company. Revenue is properly recognized at the point that the earning process needed to generate the revenue is substantially complete and the amount eventually to be received can be reasonably estimated. As the study of financial accounting progresses into more complex situations, both of these criteria will require careful analysis and understanding. Recognizing expenses at the wrong time may distort the financial statements greatly. A business may end up with an inaccurate financial position of its finances. The matching principle helps businesses avoid misstating profits for a period.